Tokens + The Future of Liquid Assets — Ivno Interview Recap

June 03, 2020

By Anthony Nixon, Developer Evangelist at R3

I’ve been working with the Corda platform for a while now — tackling developer experiences head on. Recently, I had the privilege to help revamp and streamline some of the Corda TokenSDK Java APIs. Finding developer pain-points and squashing them is the name of the game — and it has an unparalleled satisfaction to it. But at the same time, there’s this continual fascination and attraction to pull a bit further back and admire the big picture. I see the “how” everyday, but I’m always curious to the “what”. What does the next 1–5 years of digital assets look like and who’s going to be leading the charge? How are the tools and experiences my team are curating, being leveraged today to create amazing innovation?

With the preamble in mind, when I got word one of the forerunners in Token based digital cash solutions, Ivno, was taking part in an impromptu Live Conversation with Corda reps via YouTube; I thought YES I’m in! Beyond, the public static void , data-types and design patterns; what does Tokenization mean for industry? I put aside 57 min to find out!

Watch the full video interview with Ivno here:

So, who the heck is Ivno? A brief scan of their website https://ivno.io gives tell they are a 24/7 instant settlement and payment solution built from the ground up on the Corda blockchain platform. Ryan Gledhill (CTO of Ivno) was on-hand to elaborate on what this means.

First thing that’s cool here is apparently, market transactions in their current form are often subject to cutoff constraints, whether time or market induced. So our first value prop is Ivno operates in 24/7 mode — okay pretty cool. Tell me more.

According to Ryan, regarding tokens, you can have fungible (split and merge capable) or non-fungible. Ivno if a fungible token geared towards banking and institutional entities at the moment (no retail market yet). These tokens can be traded and swapped in market relevant forms. Non-fungible token assets (think unique/atomic representations of an asset such as a home or artwork) aren’t addressed in tokenized form by their solution, however, interestingly they provide settlement rails against both token representations which allows a client to leverage standard token based DVP (delivery vs. payment) advantages.

Well Ryan, why in the world do I need DVP? Ahem… He goes on to articulate how this pattern ensures that both delivery and settlement reach finality in whole! It has an immediate reconciliation on both sides and has a complete reduction in failure. A failure, commonly failure to deliver, is a transaction which has been agreed and paid for but the actual asset doesn’t end up moving. Then Ryan hits us with a statistic… wait for it…

Failures in equities in the EU, today, are up to a record 12%

Say whaaaaaat??!?! Someone call the bomb-squad because my mind just exploded ?, (scan to 10:08 of the stream to see Cais, a product manager at R3, check his hearing — before seemingly taking to his computer to revisit his equity positions).

Ryan explains regardless of the reason for failure, the key to mitigating risk is feedback. What you see is what I see. If you can get immediate feedback and immediate reconciliation, and be privy to any transactional issues in flight, you can then SOLVE potential failures to deliver. Ivno tokenization enables this. ?

How far along is Ivno? Seems to be going pretty strong. They took the approach to formulate their offering around a tangible legal framework — with input and consultation at each stage from a top US legal firm. They made the token price-stable (non-fluctuating, compared to other tokens such as XRP — whose volatility mitigates many real-world settlement scenarios). Everything is pluggable to existing market structure — so parties can leverage the solution with minimal friction. I guess that’s partly why, last year, they were able to run a pilot with 28 organizations, including 18 banks through a global trial. I have to say, as someone who is mostly aligned with POC and early stage initiatives — Ivno is rocking it!

Ok so now I’m an institution and I’m interested — how does this work?

Step 1.

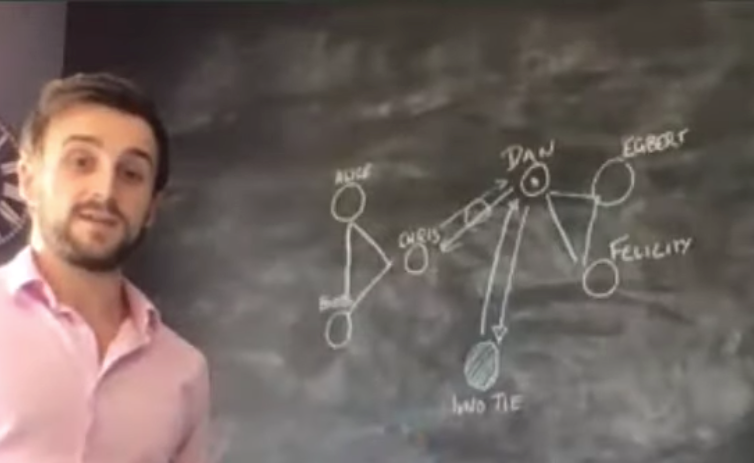

I join the Ivno business network

Business Network (BN) in a nutshell: a distinct and independently managed subnetwork in a given Corda Network — where membership and rules are maintained by a Business Network Operator, but who’s transactions and states are fully compatible with adjacent Business Networks.

I and my consortium friends can now issue tokens on the network.

Step 2.

I (my Corda node/identity) now can deposit funds and transfer value tokens to the Ivno TIE (node backed by existing market infrastructure) — in return Ivno TIE sends back to me Ivno tokens.

Step 3.

I can take my Ivno tokens and now do an atomic trade, such as a securities exchange with an adjacent equities trading Business Network.

Someone asked who’s onboard already? Apparently this is confidential… as is always the case (sigh ?) but the tone and poise with which the question is deftly deflected gives tell that there are probably some big players and fast shakers in cahoots with Ivno tokens. ?

I’m curious to know WHY, Corda Enterprise was chosen, as apparently Ryan also has a background in Ethereum. Luckily, someone asked it. Corda provides privacy, and a peer-to-peer scalable solution. As I continued to listen throughout the discussion, there seemed to be additional layers to the advantages IVNO has leveraged in CE. Some key points were the ability to offer a frictionless developer experience — Ivno has terraform scripts ready for clients, as well as seamless TestNet access. There’s the aspect of KYC (Know Your Customer) and AML (Anti-Money Laundering) off-chain processes, which can be easily modelled through reference states and vault queries on Corda. Corda Token SDK also enables mitigation of single point of failure by removing Invo TIE signatures on intermediate move operations (transfers of tokens), because obligation against the issuer is really only needed at issuance and redemption. The also utilize the Corda Accounts SDK to meet the requirements of Banking institutions to logically segregate transactions where needed. Lastly, built in metering features allow a granular view on node interactions and insight into transactional behaviour to iterate and improve the IVNO solution over time.

One cool move I think Ivno has made is choosing to go with the Corda Network — a non-profit, canonical managed, global Corda network; enabling horizontal scaling and unbiased notary services on demand. Additionally, there’s the flexibility of business verticals to have granular control over their given consortium/membership through Business Network deployments. This is a leap forward to global adoption for digital asset solutions, in my opinion. Gen 1.0 Corda deployments were often silo’d and that puts limits on both participation and trust. Moving forward towards mass adoption and large-scale interoperability is probably one of the best strategic decisions to make when you have a winning solution on your hands. ?

Well I guess for the time being my ponderous daydreams on the direction and use of tokens in modern financial industries has been satiated. I said it in the event, but I’ll say it again — Thanks Ivno and Ryan Gledhill for taking the time to layout your plans and experiences with the Corda community at large. And I really hope more of these events take place in the future as they are AWESOME!

FunFact: Apparently — Ivno is an alternate name for the Roman goddess JUNO, who is the goddess of WEALTH ?

WARNING: I don’t represent Ivno and have no affiliation with them at all, so this is just what I gathered from the discussion — my understanding could be completely off-base ?. So get in touch with them if you need a deep-dive or want to find out more. Regardless, I’ve found this talk inspiring and interesting and will definitely be following their progress and excited to see where they go with it.

Want to learn more about building awesome blockchain applications on Corda? Be sure to visit https://corda.net, check out our community page to learn how to connect with other Corda developers, and sign up for one of our newsletters for the latest updates.

— Anthony Nixon is a Developer Evangelist at R3, an enterprise blockchain software firm working with a global ecosystem of more than 350 participants across multiple industries from both the private and public sectors to develop on Corda, its open-source blockchain platform, and Corda Enterprise, a commercial version of Corda for enterprise usage.

Follow Anthony on Twitter and Linkedin.