The Internet of Public Value

April 25, 2018

The Internet of Public Value

Imagining a new Public Value Network for the UK based on the Corda Distributed Ledger Platform

The UK Government is under growing pressure to improve the performance of public services whilst reducing costs. Services are under stress at a national and local level. This pressure to improve the value being delivered to citizens whilst reducing operational costs and risks is analogous to the pressure the financial service industry has been under since 2008.

Financial services organisations are increasingly turning to Distributed Ledger Technology (DLT) to address these challenges. Distributed ledger technology is enabling a new paradigm in financial services where organisations collaborate and integrate at the infrastructure and transaction level, freeing up resources for innovation and competition at the application and value proposition level; what we are seeing is wholesale business model transformation.

This post explores how a new Public Value Network might enable Public Service Organisations to:

1. Retain their existing decentralised business models, (budgets, decision making, business, service design) yet optimise and synchronise locally and nationally

2. Collaborate in the design and delivery of frictionless human centric services

3. Automate- services, adherence to and auditing of regulation, policy and process

4. Improve financial transparency across public service value chain

Challenge

UK Public Services are no longer affordable, and there is a growing expectation gap between what citizens want from their public services and what’s affordable.

Citizens’ expectations are met on the front line, by the doctor, teacher, social worker, policeman, inspector, council worker and the public-facing civil servant.

Approach

The only viable approach to closing the expectation gap in a world of declining tax revenues and therefore declining budgets, is to make a bigger impact with the existing resources, to remove friction, cost and duplication so services can be optimised and scyronised enabling resources to be moved to front-line services that deliver direct value for the citizen.

Opportunity

It has been estimated that reducing back office administration by 40% could free up £46bn per year for front line services.

‘The first generation of the digital revolution brought us the Internet of information’. Don Tapscott

With the 1st generation of the internet brought us the large platform providers, Google, Facebook and Amazon. Governments looked at these innovative platforms and thought, surely government can be more like these businesses? Surely government can learn and replicate these business models, and yes over the past 20 years central and local government has made progress in replicating these business models, removing front line staff, carrying out ‘channel shift’ where, instead of talking to a person, you talk to an Interactive Voice Recognition (ICVR) system, or navigate a website.

Progress has been made also with reducing costs by consuming cloud-based services from large platform providers like Azure; AWS, Office 365, SharePoint, and ServiceNow — just an example of some of the common shared services that have been widely adopted by public service organisations.

Yet despite 20 years of digitising government, we have not achieved one fully integrated, fully optimised entity that delivers cohesive fully joined-up public services. On one level, despite all the funding and energy invested in building this so-called ‘fully integrated’ business model for the delivery of public services it feels like public services are still very disconnected and distinct; but then again, is it a bad thing that the delivery and culture of the service for doing farm inspections is very different than the service that provides mental health support to teenagers?

Is our awe of Facebook and Amazon as templates for Public Services still valid? Should we be holding up business models of platform / advertising providers that harvest and monetise user data up as exemplars for the design and delivery human centred public services?

‘The second generation — powered by blockchain technology — is bringing us the Internet of value: a new, distributed platform that can help us reshape the world of business and transform the old order of human affairs for the better.’ Don Tapscott

Imagine a world where instead of trying to turn the 25 ministerial departments, 20 non-ministerial departments, 300+ agencies, local councils, schools, police and wider public services into a commoditised, homogenized version of Amazon; we decided to embrace, celebrate and empower the individual specialisms and purpose of each organisation delivering a public service. What if instead of battling against the decentralised nature of these organisations culture, values, budgets, workforce and the unique character of their services we seek to radically embrace and optimise the rich tapestry of UK public service delivery?

Want to know how to deliver great public services? Ask the Bankers!

What about instead of looking to internet companies for the answers on how to

make UK public service affordable, we looked instead to financial services? Asking bankers how to deliver public services might seem ridiculous, but banks have far more in common with public service providers than Amazon or Facebook. Banks are heavily regulated, they touch the lives of every citizen, they provide face-to-face services and, like UK Public Services, they have been under massive strain to join up service and reduce costs. The following are two extracts that articulate the challenges in the financial services sector:

‘Market infrastructure has evolved incrementally over years without consistent architectural design and is characterized by siloed data stores, maintained independently by each participant. The redundant storing of common information provides resilience but gives rise to expensive and time-consuming reconciliation activities between siloed data stores as each market participant strives to ensure their books match those of their counterparties.’ Digital Asset Holdings White Paper Dec 2016

‘In particular, each financial institution maintains its own ledgers, which record that firm’s view of its agreements and positions with respect to its customer set and its counterparts. Its counterparts, in turn, maintain their views. This duplication can lead to inconsistencies, and it drives a need for costly matching, reconciliation and fixing of errors by and among the various parties to a transaction. To the extent that differences remain between two firms’ views of the same transaction, this is also a source of risk, some of it potentially systemic. A plurality of financial institutions drives competition and choice but the plurality of technology platforms upon which they rely drives complexity and creates operational risk.’ R3 Corda: An Introduction August 2016

Here’s a quote from a March 2018 paper on UK Public Services

“Bespoking your own finance or payments system, or hand-cranking your own local licensing system (instead of consuming one already available) are now no longer a productive or cost-efficient use of public resources. Yet this is effectively what much of the public sector is doing, in multiple places across many organisations — and all at great cost. Such large-scale duplication of commodity functions and processes offers little or no value to citizens. Instead, it consumes precious resources that should be going to the front line and prevents services from joining up properly around the needs of citizens and public-sector workers alike’ Better Public Service a Manifesto 2018.

What’s clear is that the essence of the problem is the same, and we believe the technology solving the problem for financial services can also solve the problem for Public Services.

Corda

To refine the remainder of this paper and get a little more specific we have chosen to zoom in on Corda, an open source blockchain platform built specifically for financial services but with far wider applicability.

The Internet of Public Value

1. How might this new Internet of Public Value enable Public Service Organisations to retain their existing decentralised business models (budgets, decision making, process, partners, value proposition and service design) yet optimise and synchronise locally and nationally?

The key point about this question is that, instead of trying to completely re-engineer the highly distributed tapestry of public service organisations’ business models into some type of centralised ‘platform’ type business model, we seek to optimise, deduplicate and synchronise the existing public service network.

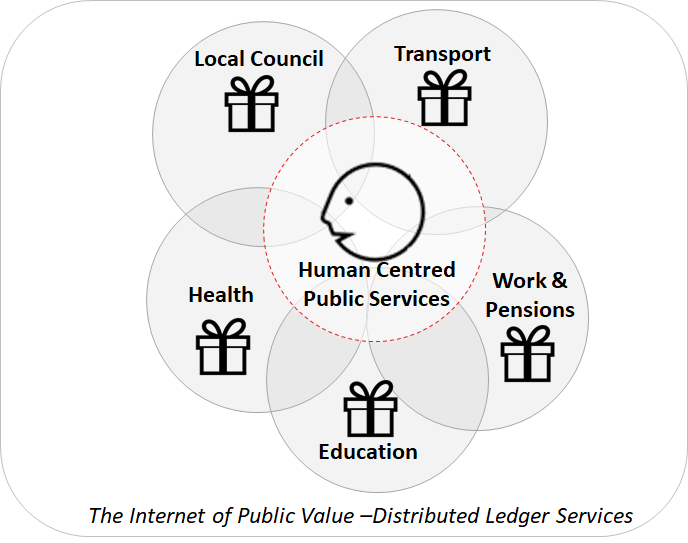

The first building block would be for each actor in the public service network to have their own node as illustrated below.

The first thing to note about a public service organisation onboarding to the Public Value Network is that they would (within the context of the overall network) individually fund, design, build and support their own node. Risk, reward and investment for joining the Public Value Network would be owned by the individual public service organisations, not with some central mega project team. There is a long list of examples where this centralised project approach has failed, including:

- NHS IT — The £12.7bn National Health Service National Programme for IT (NPfIT)

- The Department for Transport’s Shared Services — was initially forecast to save £57m

- £7.1bn Defence Information Infrastructure (DII)

- £350m Single Payment Scheme system (SPS)

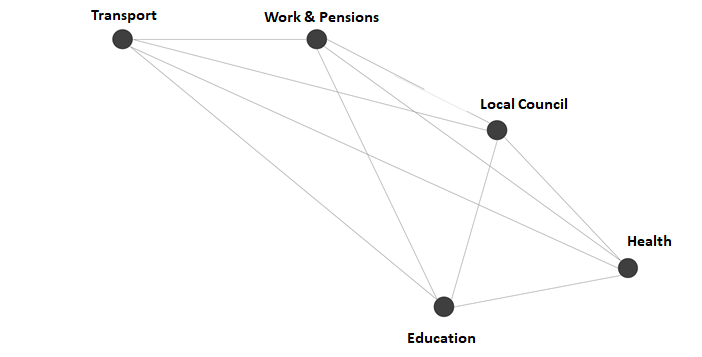

Map of the Public Value Network

As part of joining the network, each Public Value node along with the services it provides would be available to the network in the form of a searchable network map; immediately opening opportunities for collaboration and innovation.

2. How might this new Internet of Public Value enable Public Service Organizations to collaborate in the design and delivery of frictionless human centric services

We know that for decades the holy grail has been this concept of a joined-up government and joined-up public services, but until now it has not rea

lly been possible at a holistic level.

The Corda network as a peer-to-peer network has a unique feature that makes it particularly suited to be a Public Value Network. Whilst each node of the network can communicate with every other node, the design of the network means that for each transaction or exchange, the participants have to be defined and only the participants related to a transaction get to see the transaction.

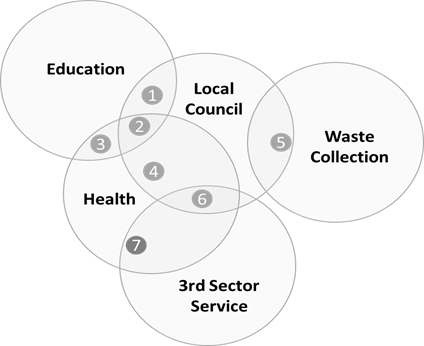

In this model above, each of the numbered circles represent a shared fact or piece of information. You can see that ‘fact 2’ (perhaps about the welfare of a child) is shared between the local council, the health service and the education service, but not the waste collection service or 3rd sector provider.

In the Corda architecture, each node has its own private ledger and can only share the facts from its ledger with those parties that need to see them i.e. a party they are jointly delivering a service with, or that is providing an adjacent service.

What this means is that when designing services around the citizens, public service organisations on the Public Value Network can come together and decide which facts they want to share and under which circumstances.

What we can see from this model is that with the peer-to-peer network described under point 1 and the node-to-node direct communication on specific shared facts, creates a new opportunity for autonomous public service entities, to integrate without friction and to design highly personalised, automated, cross-organisation joined-up services, centred on the human needs of the citizens they seek to serve.

3. How might this new Internet of Public Value enable Public Service Organisations to automate adherence to regulations, policies and procedures?

Our public services operate in highly regulated environments, in the same way our banks operate in highly regulated environments. Corda was designed from ‘the ground up’ to be able to act as a value network within the financial services industry and the smart contract features can be equally applied to a Public Value Network.

In providing public services, organisations need to adhere to regulations, policies, and procedures. In designing services that sit on the Public Value Network, service providers can automate processes and flows in smart contracts.

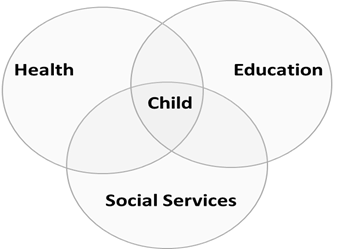

Let’s say education, health and social services come together to think about the services they provide to children. If we assume the team decide that the right implementation of legislation, regulation, policy and procedure is that, if a child presents in A&E more than once in a given period, and in the same period has a certain % absence from school, this would trigger an automated sharing of this fact with the social services.

We are not child care service experts. The purpose of the illustration is to show that (with a Public Value Network and Smart Contracts) regulations, policies, process and procedures can be automatically shared across service providers based on given events.

From a compliance point of view, all transactions and the history of data sharing is immutable so from a public trust and transparency point of view, each of the service providers can demonstrate that they acted in accordance with the regulations and this can be independently verified by a regulator.

The regulator as real-time observer. With a Public Value Network based on Corda, the regulators would have observer nodes on the network where they can observe events in real-time rather than retrospectively auditing when things go wrong. Regulation of non-compliance events can be automatically flagged to the regulator or indeed anonymously raised by participants in the Public Value Network.

4. How might this new Internet of Public Value enable Public Service Organisations to Improve financial transparency across public service value chain?

People care about where public funds are spent, people want to see investment making it to the front line, people want to see more front-line staff. There are many ways distributed ledger technology could bring transparency to public sector finances. One interesting example would be based on the concept of “wooden dollars”. Imagine if the Treasury, as a node of the Public Value Network, decided to issue at the time of annual budget, for every £1 of actual budget an equivalent digital coin.

As the budgets then flow through the system and get assigned to services, projects, and front-line agencies, the public can see in real time where the money is and where the money is being spent.

Very quickly and visually, the public could see how money flows around public services, they would see the vast sums that never make it out of the centre and the ratio between back office and front-line services. This transparency would drive a national conversation and would put increasing pressure on public service providers to join-up, synchronise, de-duplicate and ensure resources are invested in front line staff.

Conclusion

There is an ever widening gap between public services and the expectations of the public, this expectation gap cannot be met by applying the same thinking and technology that we have applied for the past decade; we haven’t got to where we need to be and more of the same is not going to change the game.

Just when we need it most, a new technology and a new opportunity has emerged. Many people still hold the banks responsible for creating the financial crisis that triggered austerity and the continued downward trajectory in Public Service funding resulting in the major expectation gap we see today; it would be a little ironic and poetic if it turns out to be the imagination and innovation of todays g

eneration of financial service professionals who end up creating the technology that repairs and restores our Public Services.