Markets are decentralised and the software that runs them should be too.

July 10, 2018

Markets are decentralised and the software that runs them should be too.

Introducing Corda Enterprise

R3 has just launched Corda Enterprise — a commercial distribution of the open source Corda platform. The world now has the ability to deploy decentralised applications to optimise today’s markets, and to do so at scale and with integrity.

Here’s the thinking…

There’s a funny little contradiction at the heart of the economy: most businesses are centralised but the markets that most businesses operate in are decentralised.

Here’s what I mean: pretty much any company you can think of has a chief executive and a head office and a board of directors and a finance department and a head of sales and a marketing team and countless other departments.

It’s a bit weird when you first think about it: the beating heart of the capitalist system consists of institutions that are inherently centralised, top-down, and run along command-and-control principles.

But if you look at the markets in which these firms operate, it is very rarely the case that there is anybody in charge. Who is the “chief executive” of the reinsurance market? Where is the “head office” of the syndicated lending market? Who sits on the board of directors for the financing of world trade? Outside trade bodies, regulators and some specific organisations in the financial markets, the answer is invariably “nobody”.

Any competitive industry you can think of is typified by a large number of producers — companies — striving to earn income by providing things that consumers — individuals or other companies — are willing to pay for. And there’s nobody in the middle who is “in charge”.

So when the IT revolution began many decades ago, it was natural that it was companies and other centralised organisations that were the natural adopters of the technology: there was a competitive advantage to be gained by optimising one’s operations, and a command-and-control mechanism to get the technology adopted and working practices changed was the way to make it happen.

So it’s no surprise that if we now look back on the achievements of the IT industry over recent decades we see that IT has mostly been deployed within firms and has mostly been used to optimise those firms — and these firms look utterly different and more efficient as a result.

But when you raise your attention to the level of industries and markets, you see something different. It’s really quite remarkable, when you think about it, how little has changed in how many markets. The way international trade looks today would be easily understandable by a merchant from three hundred years ago. The mechanics of how a complex reinsurance contract is negotiated would look little different from a century ago. And so on.

In fact, it’s only when markets have introduced centralisation, such as with the creation of highly regulated centralised infrastructure firms in the financial markets, that we’ve seen transformational change at the level of an entire industry. The results have often been spectacular. But they have come at the cost of new intermediaries, greater risk concentration and a resulting regulatory need to ensure these new institutions do not become rent-seekers or stifle innovation once established.

Why is this? Why have we been unable to transform the economics of whole industries without introducing new points of centralisation and control?

An important part of the answer is that, until now, we simply haven’t had the technology that would allow us to do it. The deepest assumptions of most of the software that exists today is that it will be deployed within a firm, that it will be controlled by that firm, and that, because it is run by or for that firm, its outputs can be trusted by people in that firm.

And so we find ourselves in today’s world, where each firm in a market has an insanely complex IT estate with hundreds or thousands of corporate applications.

Applications that all do the same thing as the applications in each of their competitors and customers!

Except it’s worse than that… not only do they have all these massively duplicated systems, none of them are ever in sync. So they constantly have to be reconciled and checked to make sure that every party to a deal or contract is in sync with each other.

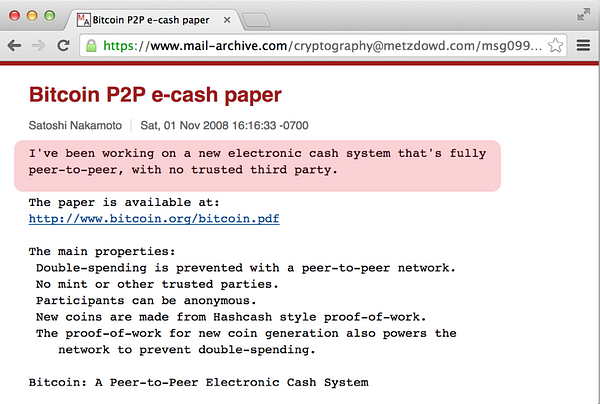

However, as I have written about extensively in the past, the advent of Bitcoin taught us something very interesting.

Bitcoin taught us it was possible to build systems that are deployed between multiple entities, whom don’t fully trust each other but desire to transact with each other… and to do so without introducing a new centralised party they must all trust.

In Bitcoin, there is a set of shared ‘facts’’ being managed. Things like: how many Bitcoins are there in the world? Which addresses own them? What would somebody need to do in order to be able to spend one of them?

But it’s a simple logical step to say:

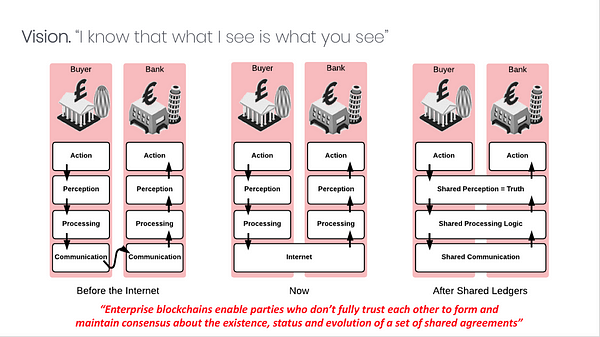

“Hang on… what would happen if the set of shared facts were things like legal contracts and healthcare records and reinsurance policies or complex loans? What would happen if all the participants in a market — who don’t fully trust each other but whom nevertheless wish to transact — had access to a system that allowed them to know for sure that what they saw on their computer was what their counterparts saw on theirs?”

This could be a massively powerful breakthrough. It could be the holy grail to optimising entire markets without forcing these markets to reshape themselves to conform to the badly-fitting centralised models that today’s software would demand. It would be the best of both worlds and could unleash a productivity revolution.

And this, of course, is what we at R3 believe is the potential of the application of blockchain technology to business. It’s the vision upon which the design of Corda is founded: the ability for anybody to transact directly with anybody else on an open network, with total assurance that “what I see is what you see’, with assured privacy, and scalability.

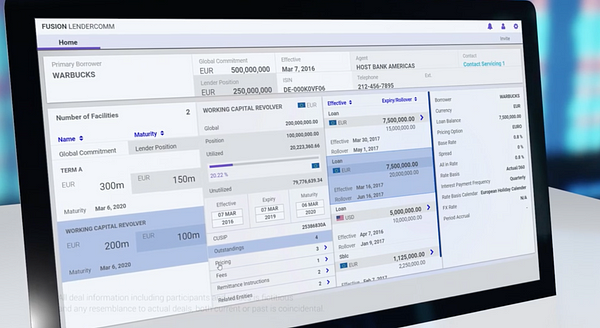

And it’s the vision that projects and initiatives such as Finastra Fusion LenderComm, B3i, GuildOne, Tradewind Markets, the RiskBlock Alliance and many others are bringing to reality across industries as diverse as insurance, healthcare, gold, oil and gas, finance and more.

And what unites these projects is that entire markets are in the process of being transformed. And it’s being done without forcing new intermediaries into the mix or driving these riotously decentralised markets into inappropriate centralised models.

That’s why I like to think of Corda — one of the few truly open source blockchain platforms — as “decentralised software for today’s markets”.

And the market understands this, of course. The world of blockchains for business is consolidating to the open platforms and that’s where the developers are heading too. This recently leaked chart from Gartner (p16) shows the amazing growth of Corda, for example.

And these GitHub stats for the year to June, which were recently unearthed by Forbes (page 2) show that Corda also has the most developers contributing to it.

Introducing Corda Enterprise

And, as I argued above, we’re now seeing deployment of blockchain software such as Corda into entire industries. Companies who make up those industries need to get the relevant software installed in their data centres or at their cloud providers.

And these companies often need commercial support for open source software they install and sometimes they also need specific features added, to a specific timeline. And they are willing to pay license fees for this software because of the value, certainty and reassurance it provides to them.

But if that software locks them in to a vendor then they couldn’t possibly risk deploying that commercial stack: the risk they would be taking for their own firms and for their industry would just be too great.

And this is where Corda Enterprise steps in.

Corda Enterprise is a commercial distribution of the Corda open source project. It comes with 24/7 support, a product management team who can get features built to your schedule, support for enterprise databases such as SQL Server and Oracle, a world-first “Blockchain Application Firewall” to make it possible to deploy a blockchain inside corporate data centres and yet be securely accessible to the outside world. And many more features. Head here for more.

But here’s the key point: Corda Enterprise is 100% compatible and interoperable with the open source platform.

That’s right: deploy Corda for an entire market, as the insurance industry globally is doing, for example, and then individual firms in that market can choose to install the commercial version for their specific needs. And yet they can be totally reassured that if they ever wanted to part ways with R3 for any reason then they could switch without losing any data or rewriting any apps back to the open source version or even to a competing commercial distribution provided by somebody else.

This interoperability and compatibility assurance is the key to squaring the decentralisation circle.

- Corda: decentralised software for today’s decentralised markets.

- Corda Enterprise: a commercial distribution of the Corda open source platform that can be deployed on a case-by-case basis with full assurance of interoperability.

No other enterprise blockchain platform offers this.

This means Corda, uniquely, has delivered the holy grail: a truly open platform that eliminates the risk of vendor lock-in yet with a commercial distribution for those who need it.

Be in no doubt. This is a ground-breaking step forward: decentralised software for decentralised markets, with no vendor lock-in.

It is why Corda’s mind share is shooting through the roof and why the first copies of Corda Enterprise were sold within twenty four hours of the code becoming Generally Available.

Head over here for a trial copy.