Corda and Settlement: Let’s Get Atomic

October 17, 2018

Corda and Settlement: Let’s Get Atomic

Digital assets on Corda include, and need, digital media of exchange to deliver on the full promise of blockchain technology. Today we are open sourcing a cash issuer repository as the first of a series of settlement-related tools for our community.

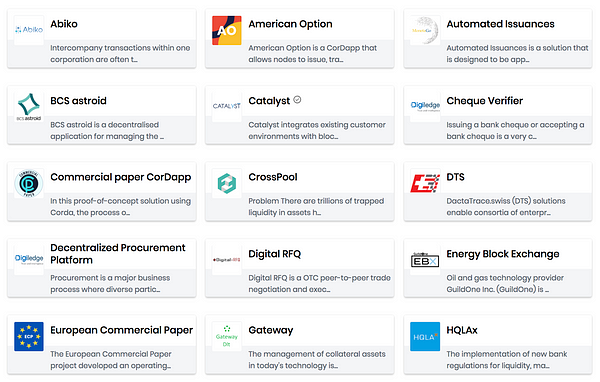

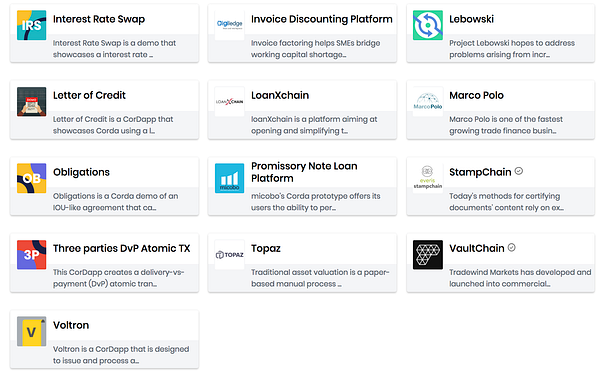

The demand for settlement on Corda is growing by the day. A quick search thru the Corda Marketplace shows dozens of digital asset apps and ecosystems that are in pilot or production:

In this post, we’ll talk about the opportunities in settling transactions and obligations from these apps on-ledger. In an upcoming post, we’ll go into more detail on how CorDapp users can also settle obligations on any other system.

Let’s Get Atomic

Our own Antony Lewis* recently wrote a great post called Banking When the Bank is Shut, which could be seen as the third installment of an unofficial series about tokens on Corda (following my earlier post and RGB’s great piece). Hidden near the end of his piece was this very relevant passage:

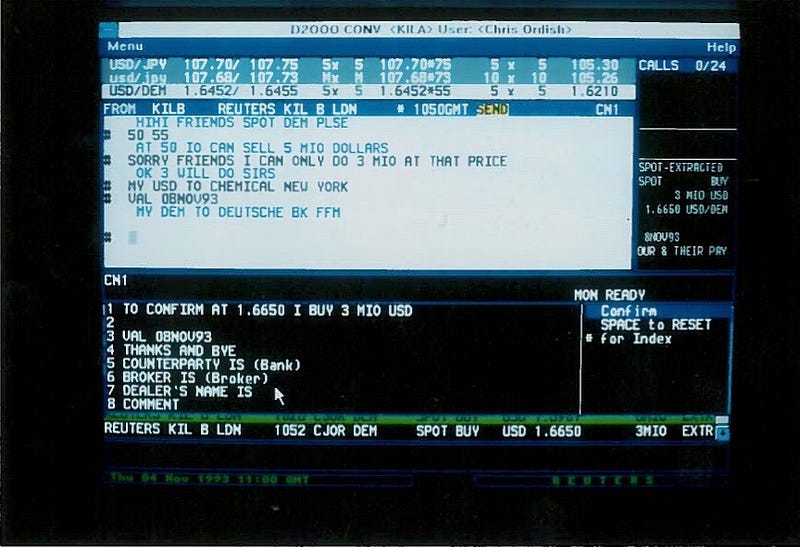

Atomic transactions and delivery vs payment. This is huge. As more assets become tokenised, transactions can be created that make changes to multiple assets simultaneously. For example, an invoice can be marked as “paid” in the same transaction as the movement of the payment — and both parties can see this simultaneously without further reconciliation. A share can be marked as “ex-dividend” at the same time as a payment made from the issuer to the beneficiary, with no confusion. A bond can be marked as “post-coupon” at the same time as the coupon is paid. A share can transferred in the same transaction as the payment. A bilateral financial derivative can have some event recorded triggered by something else, such that both parties are in no doubt as to the status of it. And so on.

This is the promise and benefit of ‘atomic XvP’ with deterministic finality. Let’s briefly break down that phrase. The ‘atomic’ part refers to both legs of an XvP transaction happening (and being committed to a database) or not, and for the participants to definitely know which, right away! This confers the benefit of the two or more counterparties achieving instant settlement finality. The ‘XvP’ can mean a Delivery versus Payment transaction (basically, exchanging an asset for money) or a Payment versus Payment transaction (straight cash homie). From day one, Corda was designed with this atomic XvP in mind.

Yet today, we have a challenge. Without digital cash available, atomic settlement relies on a coincidence of wants: the need to find a trading party who wants an asset of mine AND has an identically valued asset that I want — digital bartering! A stable, fungible medium of exchange will make this easier, just like money did for early humans. There are a few ways to do this on Corda, and most involve a known issuer of the ‘money’ asset.

Open sourcing a cash issuer repo for the Corda community

Today we are releasing a cash issuer repository for Corda. This is a reference design for issuers of asset-backed settlement assets (aka ‘cash on Corda’ or ‘money on Corda’).

It shows how a small team of Corda developers were able to:

- Use a collateral account at a real bank

- Link transactions into that collateral account with a known (and presumably KYC’d) list of CorDapp users

- Receive fiat cash in the collateral account

- Immediately issue asset-backed token as a tradable asset (a ‘state’) on Corda

- Move these states between Corda nodes

- Request redemption from the original issuer

- Pay out from the collateral account

- Destroy the digital asset on Corda

This is huge! If you missed the link above, click HERE. This reference design can serve as a guide for CorDapp developers looking to build and issue a stable, fungible medium of exchange on Corda.

For those at SIBOS 2018, you can learn more about this and much more from our Head of Product, Mike Ward. He will be presenting twice on Monday, Sept 22nd. First, at 10am at our partner HPE’s SIBOS booth (Level 4, Booth M40). Later that day, you can catch Mike at our Sydney Corda Meetup (register HERE).

The settlement asset spectrum

Of course, the real-world assets held as collateral, and the reputation of the issuer, are critical to this system. Just as there is a spectrum of settlement obligations (from paying your friend for coffee to settling a multi-billion dollar bond purchase), there is a spectrum of settlement assets. Digital money could be backed by a future promise to pay (as many coffee scenarios are settled today!), an account at a commercial bank, a risk-balance collection of commercial bank accounts, or a reserve bank account (also known as central bank money)…and in some case can be backed by nothing at all, save for the belief and understanding of the users that the asset is an acceptable medium of exchange.

Corda is unique in allowing any node in any business network to move assets to any other node — users will simply choose which ‘grade’ of settlement asset they will accept or use for each type of settlement need. And as an open platform, Corda will not prescribe which ‘grade’ of settlement asset to use.

Some users may require the lowest risk/highest quality settlement asset possible, following the Principles for Financial Market Infrastructure guidance to settle in central bank money when possible. Consortia and industry initiatives such as Utility Settlement Coin are already well-advanced on the legal framework for such a high-quality on-ledger asset, and we hope the code we are open sourcing today can contribute to their overall goals for the financial industry.

Others may only require a ‘good enough’ medium of exchange. This could include a settlement asset from an issuer below a central bank credit grade, or a native payment token for a Corda business network, or perhaps a promise to settle on a payment rail ‘somewhere else’ that is later extinguished on Corda.

We look forward to what our large and growing Corda community will produce. We hope this will accelerate the work already underway by startups, banks, and market infrastructure providers in this space…and who knows, it might even inspire a few Corda stablecoins…

Please reach out to us at [email protected] to continue the conversation.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

*Bonus shill/shout-out for Antony: tired of your friends and relatives asking you ‘what the [heck] is a blockchain’? Get them a copy of Antony’s just-released book The Basics of Bitcoins and Blockchains and tell them instead to ‘RTFB’!