Asset Tokenisation: An idea whose time has come… but not for the reasons you might expect

August 21, 2018

Asset Tokenisation: An idea whose time has come… but not for the reasons you might expect

Or “How I woke up one day and realised Corda was the world’s most compelling tokenisation platform”

This post will be controversial… I argue that the future of asset tokenisation is not Ethereum, but Corda. Hold on for the ride..!

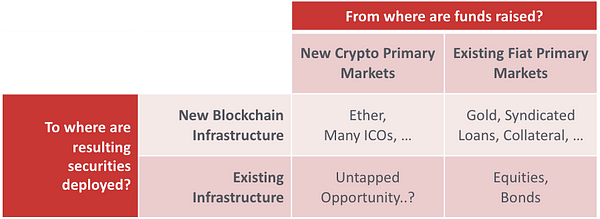

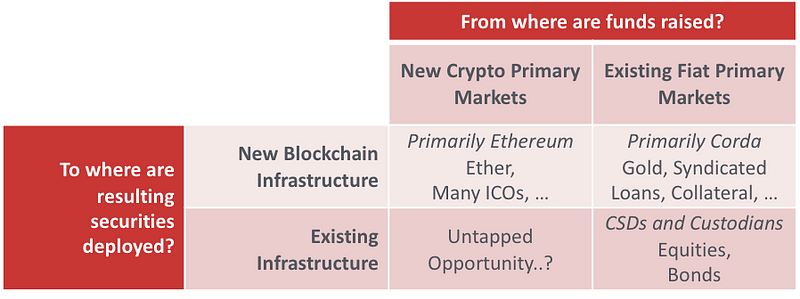

The diagram below summarises the argument I’ll be working through. In short, if you’re looking to tokenise real-world assets or claims on real-world entities, you should be targeting Corda.

In some ways, this article is also something of a mea-culpa… I haven’t done enough to surface the underlying financial primitives and APIs in Corda to the community. That changes starting today..!

I’ve argued for some time that there are two parallel revolutions playing out in the blockchain space.

The first — the cryptocurrency revolution — is represented by the growth of ecosystems like the public Ethereum network and the associated speculation and infrastructure build-out.

The second — the enterprise blockchain revolution — is represented by the work I do here at R3. Corda, the open source platform my team supports and maintains is focused on applying the idea of “what you see is what I see” — WYSIWIS — to business applications: enabling us to think about optimising entire markets in a truly decentralised fashion.

The interesting thing is: many of the most exciting first deployments of Corda are what you might describe as Enterprise Tokens. Whether it is gold or tokenised government bonds or next-generation application tokens or even tokenised syndicated loans, we’re seeing the same pattern over and again: optimisation of these markets is happening across open platforms, but open platforms with well-defined governance, settlement finality, strong identity and tight integration with existing infrastructures.

In short, it’s happening on Corda.

This leads me to make what you might think is a heretical claim: as the cryptocurrency and enterprise blockchain worlds race to form the foundation of the next generation of financial markets, we will increasingly see it happen using technology from the enterprise blockchain world rather than technology built for the cryptocurrency world.

In fact, I also soon expect to see tokens that were first issued on public blockchains being immobilised in place and ‘teleported’ over to Corda to take advantage of Corda’s superior transaction finality, regulatory friendliness, strong identity layer, and tight integration with the existing financial system.

This is an audacious claim… so let me explain what I mean and why I believe it.

A simple explanation of investment banking

First, let’s refresh our memories about how today’s markets for capital work.

Imagine you have a new business idea. You need to raise funds and there are a bunch of ways of doing this. It’s complicated and there is a range of people who can help you with the process. How to access markets for capital? Should you issue more equity? Take on debt instead? Maybe you need help figuring out how willing people might be to invest and at what price. Perhaps you need somebody to help you find the investors and oversee the process. Maybe you want to go even further: you want somebody to guarantee you can raise the amount you need so that you can plan for the long-term.

We call the people who provide all these services ‘investment bankers’. And we say you’re engaging in ‘primary market’ activities: the thing you offer in exchange for money is being issued for the first time.

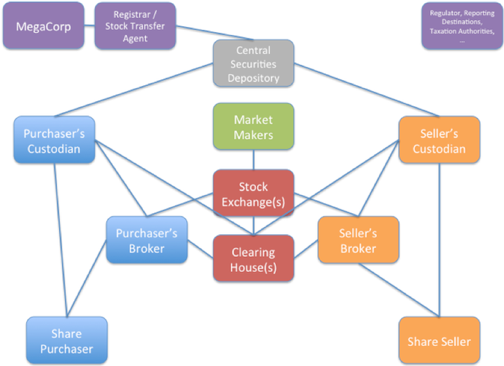

The second-hand market for these things (equity, bonds, etc) is called the secondary market. It’s where the people who first invested can go find other people to sell to. The secondary market is where things like stock exchanges and retail brokerages mostly focus: handling second-hand securities. The infrastructure to make this work at scale are things like clearing houses, exchanges, custodians, central securities depositories and broker-dealers.

I wrote about how securities move around the world financial system several years ago and it’s pretty complex:

But when we net it all down, it’s a simple model: primary markets are where you first raise capital, and secondary markets are where the resulting securities can be bought and sold as if they were second hand cars.

And there is a symbiosis: without a primary market, there would be nothing to trade in the secondary market; and without a secondary market, people would be less willing to invest in the primary market. Who would you sell to when you finally want to realise your gains?

So let’s now take a look at what’s been happening in the world of public blockchains and token issuances. Are the same concepts being applied?

A quick survey of the public token phenomenon

Hundreds of projects, of various degrees of sophistication, credibility and propriety, in the form of ICOs and ‘Token Sales’ have raised amazing sums of money to accelerate their growth in recent years. But rather than accessing the deep and liquid market of USD- or GBP- or EUR-holding investors, they did so by marketing their securities to holders of cryptocurrencies, typically Bitcoin and Ether.

Now if that was where the story stopped, it would be fairly uninteresting. The story would be: “entrepreneurs discovered a new pool of capital and tapped that rather than the existing markets for capital”.

Except… the story didn’t stop there. It is playing out very differently, in two distinct ways.

Firstly, the resulting assets — the things that the investors had paid their Bitcoin and Ether for — did not then get placed in a Central Securities Depository and traded on the secondary market by the existing financial firms. Instead they exist as smart contracts or native tokens on platforms like Ethereum or entirely new networks.

And a parallel secondary market infrastructure to service these assets and enable them to be bought and sold and so forth is being built up by entirely new firms. It’s as if the outlines of a new secondary market infrastructure are slowly taking shape before our eyes and the incumbents are nowhere to be seen.

This phenomenon explains the emergence of standards like Ethereum’s ERC-20, since it means all these different assets issued by different projects all have a common ‘socket’ into which infrastructures like exchanges and custodians — aka ‘wallets’ — can‘plug’.

But this raises the obvious question: why are the new crypto firms going to such lengths to implement these parallel sets of infrastructures? Why not just use the legacy ‘rails’?

Part of this is undoubtedly due to the reluctance of the legacy firms to engage with this world. And some is due to the philosophies of those spearheading this revolution on the cryptocurrency side. But I don’t find either explanation satisfactory on their own.

It feels like there must be an extra reason that explains why this parallel infrastructure is being built. And this reason is at least partly because these new assets mostly do not look or behave like traditional equity or fixed income securities. For example, they often have richer behaviours, often directly controlled by code in the form of “smart contracts”. And sometimes they need to “live” on the same platform as the service they were raised to fund so that the act of consuming one of these new services can happen concurrent with payment in some of the project’s own tokens. And there is almost always a strong desire for these tokens to be transactable 24/7, and to be interoperable with other tokens and applications on the same platform.

So we can summarise what’s going on:

There is a new primary market for those raising capital: people with crypto wealth. And the assets issued to these people are not just traditional equity and debt that live in a CSD and are serviced by custodians but far richer in their structuring and behaviours. As a result, these new assets are being ‘deployed’ to new secondary market infrastructures.

But not all new blockchain-based secondary market infrastructures are created equal… I’m going to argue that open enterprise blockchain infrastructures are the natural home for these new tokens, these new tokens with new and sophisticated properties, and that this applies regardless of whether the initial funding was in crypto or fiat.

And that the pre-eminent and obvious such platform is Corda.

The key insight: primary and secondary market infrastructures do not need to be coupled

It’s useful at this point to think back on the points above and observe that the questions of from which capital pool a company raises funds and to which market infrastructure they issue the resulting assets are entirely unrelated.

For example, the Ethereum network raised its initial funding in Bitcoin but the resulting token lives on a completely different platform, the Ethereum network. Conversely, projects like HQLAx and Tradewind Markets issue their tokens to investors with fiat currency but the resulting tokens live on an enterprise blockchain: Corda.

We can represent this in the diagram below:

Tokenisation of real-world assets is happening faster on open enterprise blockchains

We are already seeing early signs of the insight I describe above. Firms are already issuing tokenised assets onto Corda in increasing numbers. We believe this is happening because some specific aspects of Corda’s design make it an especially attractive target for such issuances. Specifically:

- Settlement finality, which enables the real-world issuer to demonstrate compliance with associated finality regulations as well as reduce their own risk stemming from blockchain ‘reorganisations’ that can occur on other platforms.

- Strong identity layer, which enables firms to know who is holding or has held tokens they have issued. Important when you care about staying compliant.

- Universal interoperability design, which allows issuance of multiple different assets on the same network, enables sophisticated transaction types (eg DvP) as well as meaning ecosystem providers (exchanges, etc) need integrate only once (a la ERC20) — just like on the public Ethereum network but without that platform’s downsides.

- Many of the world’s largest financial institutions, who helped design Corda in the first place, are deploying production-quality Corda nodes, meaning Corda is the platform that bridges seamlessly from the old world to the new.

Traditional financial firms and non-cryptocurrency new entrants are already building out a new secondary market infrastructure.

On Corda.

Just like in the public blockchain space, this new infrastructure is 24/7, real-time, supports complex business logic, facilitates multiple different types of asset on the same platform, and offers broad-access.

The starting gun has been fired

As Alex Rampell of Andreessen Horowitz once said

“The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.”

The irony of the current situation is that the race is running in both directions.

In one direction, we have new pools of capital and entirely new ways of thinking about how the assets issued in return should behave. Platforms like Ethereum are fraught with regulatory and technical difficulty but as a proof of concept show what can be done. This world has solved the hard problem of tapping a new capital market, of demonstrating that you can build a parallel post-trade infrastructure and demonstrating the catalysing effects of interoperability and standards.

But there is a mountain to climb to take codebases designed to create new digital assets such as Ether and transform them to support a true secondary market infrastructure. Sometimes I think it might just be easier to immobilise any high-quality assets that already exist on those networks and ‘teleport’ them over to a superior venue. (By ‘teleport’, I mean the blockchain-equivalent of an ADR — ‘immobilise’ on the host platform and reissue on the target platform using techniques such as hash time locked contracts).

And in the enterprise blockchain direction, we see people who have solved the hard problems of transaction finality, regulatory compliance, investor protection, integration with existing systems and, perhaps most critically of all, providing a path for the world’s existing investor base who use today’s existing financial system to participate. But, as of now, they do not have full exchange integration, a range of interoperable wallets or the mindshare of some of the innovative firms driving this new approach to capital raising.

So we are indeed in a race…

In the coming weeks and months we’re going to be enabling the Corda community with more tools to tokenise and issue assets even more easily. And we’re going to see more and more firms issuing enterprise tokens on Corda. Tokens that enable 24/7 transactions, settle with finality, enable the issuers and holders to do so whilst meeting their regulatory obligations, tokens with legal underpinnings and support from real-world custodians and asset issuers.

Now is the time to get involved… jump on the corda-dev mailing list and get started by building your app on the world’s most developer-friendly and open source blockchain platform!